The thrust of the 2025 Budget presented in Parliament by the Minister of Finance, focused on making Malta a country driven to quality and continue sustaining Malta’s economy through incentives, social justice, and sustainability to ensure a better quality of living.

Fiscal and Economic Review

Over the past years, the Maltese economy experienced remarkable economic growth, leading to a rapid convergence in per capita income levels, surpassing the European Union (EU) average. Coupled with a strong labour market, this comes on the back of sustained increases in productivity, enabled by the development of high value-added industries. Consequently, the rise in per capita income levels was accompanied by higher productivity growth, leading to a constant closure of the productivity gap with the EU.

However, absolute productivity levels remain lower than the EU average, suggesting further scope for productivity improvements going forward to achieve sustainable economic growth. The Maltese economy maintained its positive performance during the first half of 2024, proving relatively resilient, amidst a weak external environment. During the first half of 2024, the Maltese economy expanded by 9.6 per cent in nominal terms, and 5.9 per cent in real terms. Domestic demand emerged as the principal driver of growth, propelled by a strong labour market, and easing inflation, which contributed to the partial recovery in households’ purchasing power. Export activity also contributed positively, bolstered by the strong performance in the tourism sector. From a sectoral level, growth was predominantly driven by the Services sector, further reinforcing itself as the main source of growth in the Maltese economy. Positive performances were recorded across most sectors, most notably in Real estate, Financial and insurance activities, Construction, and Professional and administrative services.

Global inflationary pressures have largely abated, as global commodity prices continued to broadly decline from the peaks observed at the height of the war in Ukraine. At the same time, while supply chain bottlenecks have normalised, new risks emerged centred around geopolitical tensions, as evidenced by the rise in freight costs following disruptions in main shipping lines. In Malta, the harmonised index of consumer prices (HICP) inflation rate for the twelve-month moving average stood at 3.1 per cent. This indicates that inflation has been declining gradually over the past year, moving close with the EU average.

At the end of 2023, the Maltese population stood at 563,443 individuals, a 33.7 per cent increase when compared to 2012. This growth was largely driven by net migration which amounted to 20,960 individuals in 2023. In terms of employment, activity rates exceeded 80.0 per cent of the working population during this year.

In the twelve-month period ending April 2024, Malta’s full-time employment in the private sector increased by 7.3 per cent, continuing the post-pandemic labour supply recovery. This growth is attributed to the construction and manufacturing sectors in direct production and the accommodation and food services activities and administrative and support service activities in services employment.

In 2023, Malta’s total imports amounted to €8,719.2 million, while total exports reached €4,586.5 million, both marking declines compared to 2022 by 8.9 per cent and 2.8 per cent, respectively. The trade deficit improved to €4,132.7 million, primarily due to a reduction in capital goods imports. In the first eight months of 2024, exports increased by 11.3 per cent, while imports grew by 1.4 per cent, contributing to a trade deficit of €2,879.3 million. The export rise of €322.5 million was driven by increased exports of fuels and lubricants, while imports grew by €81.2 million due to higher fuel and industrial supplies. Malta’s current account balance registered an improvement during the first half of 2024, increasing to a surplus of 5.5 per cent of GDP compared to 3.9 per cent in 2023. This improvement was largely driven by higher exports of services, particularly in travel and financial services, which helped offset the goods deficit. Malta continues to rely heavily on service exports, which are crucial to maintaining a positive current account balance, as the country remains a net importer of goods.

In 2023, Malta’s Consolidated Fund recorded a deficit of €808.0 million, a €76.9 million improvement from the previous year. Recurrent revenue grew by €545.1 million, though this was partially offset by a €468.3 million rise in expenditure. By year-end, central Government debt reached €9,739.9 million, an increase of €909.9 million over 2022. According to the European System of Accounts (ESA 2010), Malta’s general Government deficit was €938.9 million, representing 4.5 per cent of GDP. The deficit improved by €15.5 million, despite increased spending. Government revenue, buoyed by strong private consumption and a robust labour market, grew by 10.5 per cent, while expenditure increased due to higher capital transfers. Meanwhile, the general Government debt-to-GDP ratio decreased by 1.9 percentage points to 47.4 per cent, remaining comfortably below the EU’s 60.0 per cent threshold.

The fiscal and financial measures in summary include:

- The Cost of Living Adjustment for 2025 will be €5.24 per week.

- Students’ stipends will also increase pro rata of the cost of living adjustment.

- The National Minimum Wage will increase by €8.24 per week, that is, €221.78 per week and this will remain exempt from tax.

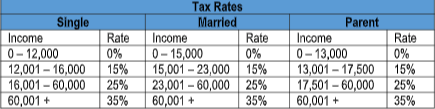

- The tax on personal income will decrease as follows:

- Using the Single tax rates, a person will benefit from a reduction between €435 and €675 per annum. The persons who will benefit most, using these tax rates will be those earning more than €19,500.

- Using the Married tax rates, a person will benefit from a reduction between €345 and €645 per annum. The persons who will benefit most, using these tax rates will be those earning more than €28,700.

- Using the Parent tax rates, a person will benefit from a reduction between €375 and €650 per annum. The persons who will benefit most, using these tax rates will be those earning more than €21,200.

- Any employee who starts employment for the first time or changes his/her employment, will have the opportunity to invest in an Occupational Pension Plan. The employer will not have the obligation to pay a contribution, however, the opportunity must be given to the employee, and it is up to the employee to take the offer or refuse it. The current fiscal benefits will remain available to both employer and employee.

- The Government will be paying the same amount of contribution paid by his employees in the Occupational Pension Plan, up to a maximum amount of €100 per month.

- The benefits of the Occupational Pension Plan will also be available to persons who are already benefitting from a private pension plan.

- Pensioners will receive another increase of €8 per week or €416 per annum, including the cost of living adjustment.

- Pensioners born before 1962 and who would still be in employment earning more than €23,500, will have another adjustment in their pension.

- The exemption from tax on pensions will increase by another 20%, so that 80% of the pension amount is tax-free for 2025.

- Widowers will remain exempt from tax and will receive an increase of €3 per week, in addition to the increase of €8 per week, in their Widows’ Pensions so that by 2027, they will be in receipt of a full pension equivalent to the amount that their spouses would have received had they remained alive.

- An adjustment in the rates of the bonus paid to pensioners will remain ongoing for the coming years up to 2027, so that the pensioners will be entitled to the full bonus of €21.53 per week.

- Service pensions will increase by another €200 so that the total amount for 2025 will be €3,666.

- Persons who were not eligible to receive a pension as their social security contributions paid were less than the required amounts, started receiving a bonus from 2015 based on the number of contributions paid. For 2024, whoever paid 4 years’ contributions, received an amount of €500 and €600 was received by persons who paid between 5 to 9 years’ contributions. From 2025, there will be a change on how the bonus will be calculated so that it is based on the actual number of contributions paid. This will vary between €550 for persons who paid 1-year contributions to €1,000 to persons who paid 9 years’ contributions.

- Persons born in or after 1976 will be required to pay an additional year of social security contributions to be entitled to the full pension. Thus, resulting in 42 years’ contributions to be paid instead of the current 41 years’ contributions.

- The pension retirement age and the rates of social security contributions will not increase.

- The supplement of the Children’s Allowance will increase by €250 per child, irrespective of the family income. Furthermore, it was also announced that government plans to introduce a change that excludes both social security contributions and income tax from the income used to determine allowance eligibility.

- The in-work benefit will continue to be provided for every child under the age of 23 years.

- An allowance of €500 per year will be given to parents whose children continue to pursue a post-secondary education. This allowance will be given up to a maximum of 3 years. Therefore, the total allowance given will be of €1,500.

- In 2024, families will receive a bonus of €500 for their first born (in or after 2024) and a bonus of €1,000 for their second child. An additional bonus of €1,500 will be given for the third child. These bonuses are also available for families who adopt a child.

- A marriage grant of €1,000 will be given to couples who get married (€500 per spouse). This has increased by circa €170 from 2024.

- Couples who are self employed and undergoing IVF treatment will be entitled to benefit from 100 hours of paid leave for each treatment cycle. The 100 hours to be divided as follows: 60 hours for the prospective mother and 40 hours for her partner).

- Self employed fathers will now benefit from 10 days (80 hours) of parental leave for every child born or adopted.

- Parents fostering a child will be given an additional allowance of €10 per week per child fostered.

- Similar to previous years, the bonus given to families (according to their income stream) will continue to be given in 2025. The benefit ranges from €100 to €1,500 every year.

- The tax refund paid in the past years, ranging between €60 to €140, will be paid again to individuals earning less than €60,000.

- Low or middle-income families will receive an additional allowance of between €100 and €1,500 every year. The payment will be divided into two instalments the first instalment will be paid out in December 2024 while the second instalment will be paid out towards the middle of 2025.

- There will be an increase in the supplementary allowance paid to married and single individuals. The supplementary allowance for married couples will increase by €190 to€1,289 per year. While that of single individuals will increase by €69 to €667 per year.

- There will be a revision in the parameters with respect to capital assets test for the eligibility of various social assistance programs.

- A new allowance will be provided to individuals who have medical conditions preventing them from working. Families will receive an additional €5 per week for every member of the family.

- There will be a revision in the parameters with respect to the eligibility for Medical Assistance.

- As from 1st January 2025, individuals aged 75 and over who benefit from the Supplementary Assistance will also qualify for free medicines.

- Individuals who overcome their drug addiction, after successfully completing the adequate rehabilitation program and have a fixed place of employment/self- employment will qualify for two years of credited social security contributions.

- Increase in pension for people with disabilities who have retired from work. This increase will seek to compensate the loss of disability assistance.

- Further assistance given to people with disabilities:

- Assistance will increase in line with the minimum wage increase.

- Increased Assistance for people with severe disability will be increased by €7.42 per week.

- Assistance for people with disability or severe disability will be increased by €3.49 per week.

- Increased Assistance for carers will be increased by €5.24 per week.

- Allowance given to families with children suffering from physical or mentaldisability will be increased by €5 per week.

- There will be a revision in the parameters for those eligible for the Carers’ Grant to families with children with disabilities.

- The tax credit currently given to parents of children with disabilities to help them with therapy expenditure will increase from €500 to €750. A scheme will be introduced for parents whose income is below the taxability threshold so they will still avail themselves from this benefit.

- The grant given to elderly individuals aged 75-79 who live in their own home or residential home for which they pay out of pocket will increase from €50 to €350.

- The Carer at Home Scheme will increase by €500 to a total of €8,500 per year.

- A tax credit of up to €500 will be given to companies which donate to voluntary organisations in social, environmental, and animal protection sectors.

- The maximum annual income amount for rent subsidy will be increased by €1,000.

- First time property buyers will continue to benefit from the Grant on First Residence Scheme and the reduction in duty on documents.

- Parents whose children attend independent private schools will benefit from an increase in the allowable deduction against their taxable income as follows:

Kindergarten – €3,500 (Increase of €1,900)

Primary School – €4,600 (Increase of €2,700)

Secondary School – €6,500 (Increase of €3,900)

- Children whose family is part of the Scheme 9 Programme will be given €150 worth of books.

- All children in primary, middle and secondary level will be given a €20 book voucher to be spent at the 2025 Malta Book Festival.

- A grant of €150 shall be provided for persons that work atypical hours in certain sectors.

- The Government shall be subsidising the first 6 months of gym membership for youths born between 2005 and 2007.

- Discussions with the European Commission regarding the implementation of measures and incentives that Malta wishes to adopt in the form of grants and tax credits, better known as Qualified Refundable Tax Credits (QRTCs) to ensure that these are in line with EU and OECD Regulations.

- The relaunching of the Seed Investment Scheme, which specifically incentivises investors to invest in local start-ups.

- The transfer inter vivos of shares in family businesses from parents to their children or other specific family members shall continue to be subject to the reduced stamp duty of 1.5%.

- An incubation centre for businesses shall be created with the aim of assisting start-ups with expanding their operations.

- Plans for the issuance of specific legislation regarding family offices, leasing of aircraft, Fintech, and AI, as well as a proposed legislation regarding Limited Partnerships, with the aim of introducing and promoting new business sectors.

- Initiatives to encourage the setup of back-office services such as administrative and support services in licensed and non-licensed sectors.

- The measures related to Highly Qualified Persons shall be extended.

- Proposed incentives for non-commercial farmers currently leasing land from the Government to enter into arrangements with commercial farmers to work their land, as well as a pilot project whereby agricultural land will be offered for lease to new farmers or those expanding their operations.

- The introduction of an authority dealing with food safety.

- A fiscal incentive for food producers and sellers whereby products that are close to their expiration date will be provided to those with social needs or else sold at a reduced price.

- A reduction in the excise duty on beer with low alcohol content produced by small or independent breweries in Malta and for small wine producers.

- Schemes aimed at encouraging the installation of PV panels, battery systems for the storage of renewable energy, heat pump water heaters and water purifying system shall continue to be provided.

- The scheme incentivising persons to purchase new electric vehicles and motorcycles shall be extended and a maximum grant of €2000 for motorcycles and €8000 for cars or small vans shall be given in case of purchases of new vehicles or motors.

- The vehicle scrappage scheme and the incentive scheme for the purchase of new pedelecs and e-kick scooters shall continue to apply.

- Electric vehicles and plug-in hybrids with an electric range of 50km or more shall continue to be exempt from registration tax and annual licence fees for a period of 5 years from the date of the initial registration.

- Other environmental related schemes aimed at incentivising vehicles to shift to LPG or electric power and the purchase of motor assisted bicycles shall also be extended.

- A national strategy aimed at promoting cycling as an alternative means of transport.

- Building & Construction Authority to extend its professional services (lawyers and architects) to third parties negatively affected by the construction industry.

- Extension of existing initiatives such as “Irrinova Darek” Scheme to assist family with low-medium income, to renovate their homes in line with sustainable and efficient energy practices.

- Extension of fiscal incentives in connection with property which had been constructed for more than 20 years and has been either vacant for more than 7 years, or is situated in Urban Conservation Areas (UCA). The fiscal incentives apply also to new properties 7 Budget 2025 Highlights developed in line with the approved criteria. An exemption from Duty on Documents and tax on capital gains on the first €750,000 of the transfer value and savings on Value Added Tax (VAT) capped at €54,000 on the first €300,000 of restoration expenses. The incentive extends further to a cash grant to first-time buyers and amounting to €15,000 if the property is in Malta or €40,000 if it is in Gozo.

- Reduction of VAT rate to 0% on women’s sanitary products and other medical accessories used by women in connection with cancer illnesses.

Disclaimer

The above information is being provided as a general guide only and should not be

considered as a substitute for professional advice.