Electricity Bills Refund Scheme

As part of the economic regeneration package, Malta Enterprise has just launched a scheme to refund part of the electricity bills incurred by businesses. These are the salient points of the scheme.

• All those businesses that benefitted from the wage supplement scheme (Annex A,B,C), are eligible for the electricity bills refund.

• The refund covers 50% of the electricity bills Jul-Sep 2020.

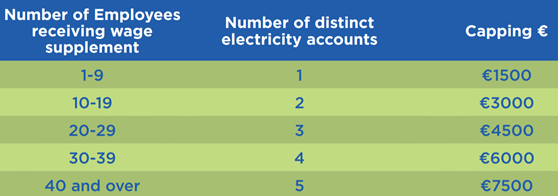

• There is a capping according to the outlets operated and number of employees as per below:

• Malta Enterprise soon will send an email to those businesses that benefitted from the Wage Supplement scheme. In the email there will be a link for the electricity refund online application.

• These documents should be submitted with the application: scan of Arms bill for period prior July 2020; Signed ‘Enterprise in difficulty form’; Signed ‘Aid received form’.

• After the necessary verifications with ARMS, the refund will be effected in more than one payment and processed similar to the COVID Wage supplement.

Rent Refund Scheme

Malta Enterprise has also launched a scheme to refund part of the rental costs incurred by businesses for the period July to September 2020. Over 20,000 enterprises that have been granted the Wage Supplement will be able to apply for a grant by submitting their lease agreements.

These are the salient points of the scheme.

- All those businesses that benefitted from the wage supplement scheme (Annex A,B,C), are eligible for the rent refund.

- The scheme is available only to tenants.

- The refund is applicable only on commercial rent agreements entered in force before 9th March 2020. The property should be rented from private sector third parties specifically for the carrying out of economic activities. Rent agreements with related parties and with MIP are not eligible.

- The aid is in the form of cash grant and is structured as following:

- Malta Enterprise on 9th September will send an email to those businesses that benefitted from the Wage Supplement scheme. In the email there will be a link for the rent refund online application.

- These documents should be submitted with the application: copy of rent agreement; proof of last payment (should cover part or full 2020); Signed ‘Enterprise in difficulty form’; Signed ‘Aid received form’.

3a Malta can provide its assistance in the application process. For more information kindly contact us on [email protected]